Purpose of This Blogger: Informal dialogue aimed at facilitating a constructive exchange of ideas between the decision-makers, stakeholders, and experts across various sectors.

Total Pageviews

Monday, February 27, 2023

Mahindra 700 Out of box Vehicle Made in India- advance feature, very lucrative look

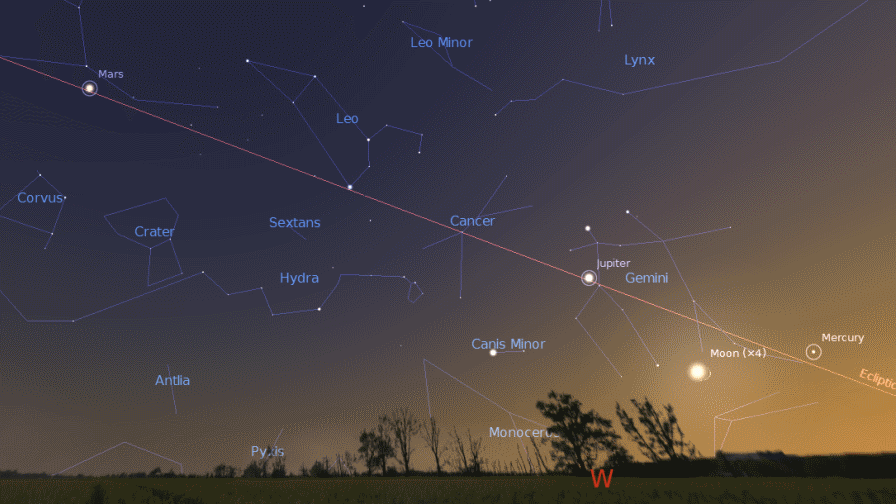

Amazing view. March 28. Just after sunset, the five planets will come together in rare alignment

March 28. Just after sunset, the five planets will come together in rare alignment

The five planets will be best seen on March 28

Jupiter, Venus, and Mars could be seen by the naked eye due to their

higher brightness, however, Mercury and Uranus could be trickier to

spot, since they will be dimmer. You might need binoculars to see the

two planets in the evening sky.

Mercury, Jupiter, Venus, Uranus, and Mars will line up with the Moon in

the skies in one of the most awaited celestial dance as seen from Earth.

Venus, Uranus, Moon, and Mars going upwards.

Venus will be one of the brightest things in the sky, and Mars will be hanging out near the moon with a reddish glow. Uranus could be seen with a greenish glow just above Venus.

Amazing view. 23 Feb 2023 Venus, Jupiter and Moon in a line

Thursday, February 23, 2023

Educational services: Tax on coaching centres in India

Educational services:

Tax on coaching Centres in India

Ref : Economy Times, PIB

The incomes of coaching centres are also covered under this act and are taxable under the head “Income from Business and Profession

Profit from tuition

Compulsory Maintenance of Books of Accounts

Books of accounts have to be compulsorily maintained, where income exceeds Rs 2,50,000 or total sales, turnover, or gross receipts exceed Rs 25,00,000 in the previous three years. Books of Accounts are to be maintained for 6 years from the end of the relevant financial year.

Books of Accounts include:

Cash Book

Journal

Ledger

Copies of Bills/Receipts

Daily Cash Register

Trading Account

Profit & Loss Account

Balance Sheet

How to calculate tax for coaching institutes

If a person wants to adopt presumptive income under section 44 ADA, then his income will be taxable on presumptive basis @50% of total gross receipts.

However, if the person claims to have higher income than above 50%, then he has to maintain proper Books of Accounts, and tax has to be paid on Net Income i.e. Gross Receipts less all expenses relating to Business.

GST on Coaching Institutes

Since coaching centers are neither offering an acknowledged degree/diploma, nor complying with the particular academic curriculum therefore they are taxable @ 18% under GST Act. Only the supply of books is exempt. If the coaching institute is providing services like transportation, food, housekeeping services or stationery or any such other facilities, then all such facilities are taxable under GST.

Since coaching centres do not provide any recognised qualification or adhere to a certain curriculum, they will no longer be exempted from GST and will be required to pay 9 % state GST in addition to 9 % central GST.

In entry number 66 of the notification, it is mentioned that there will

be an exemption to specific institutions, if those are offered by an

educational institution, subject to specific conditions. The conditions

are stated as follows:

The service offered is associated with education.

Education is offered as part of the academic curriculum.

Education is provided for acquiring a qualification identified by any law that is in effect for the time being.

The Central Board of Excise and Customs (CBEC) also affirmed that private coaching institutions will no longer be regarded as educational institutions. So, private coaching establishments can’t get any tax exemption. Additionally, the coaching imparted at those private establishments isn’t regarded as a recognized qualification.

Conclusion

Coaching centres have to file GST

returns in GSTR-1 and GSTR-3B either monthly or quarterly according to

their total invoice amount. If they have opted for the Composition

Scheme, then they have to pay tax in CMP-08 and file GSTR-4 once in a

year.

- If a person wants to adopt presumptive income under section 44 ADA, then his income will be taxable on presumptive basis @50% of total gross receipts.

- Cash Book

- Journal

- Ledger

- Copies of Bills/Receipts

- Daily Cash Register

- Trading Account

- Profit & Loss Account

- Balance Sheet

Saturday, February 4, 2023

Competition Exams for scholarship for school Students of Class 1 to 12

Wednesday, February 1, 2023

BUDGET 2023- DIRECT TAXES

- Rebate limit of Personal Income Tax to be increased to Rs. 7 lakh from the current Rs. 5 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to Rs. 7 lakh to not pay any tax.

- Tax structure in new personal income tax regime, introduced in 2020 with six income slabs, to change by reducing the number of slabs to five and increasing the tax exemption limit to Rs. 3 lakh. Change to provide major relief to all tax payers in the new regime.

New tax rates

|

Total Income (Rs) |

Rate (per cent) |

|

Up to 3,00,000 |

Nil |

|

From 3,00,001 to 6,00,000 |

5 |

|

From 6,00,001 to 9,00,000 |

10 |

|

From 9,00,001 to 12,00,000 |

15 |

|

From 12,00,001 to 15,00,000 |

20 |

|

Above 15,00,000 |

30 |